Excel Formula Help - Compound interest with FV

In this Microsoft Excel blog we will look at two ways to calculate compound interest. First, we will follow the manual written formula, then we will look at Excel's built in compound interest function, FV (Future Value).

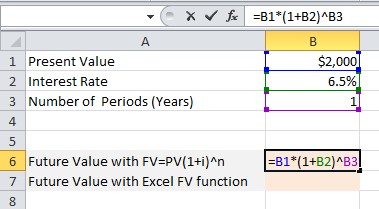

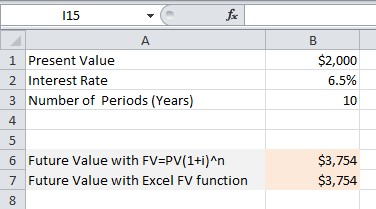

We first start with a very simple deposit sheet; we have $2,000 on account an we are recieving 6.5% annual interest. To calculate the interest over a year we follow the formula where future value =PV(1+i)^n

Here, PV is the Present Value of the loan, $2,000, i is the interest rate, and ^ refers to the compounding or exponential effect of n, which refers to the deposit period.

In the image below, we can see there has been no compounding effect as the period has only covered one year. So far we only have 6.5% of $2,000 after 12 months.

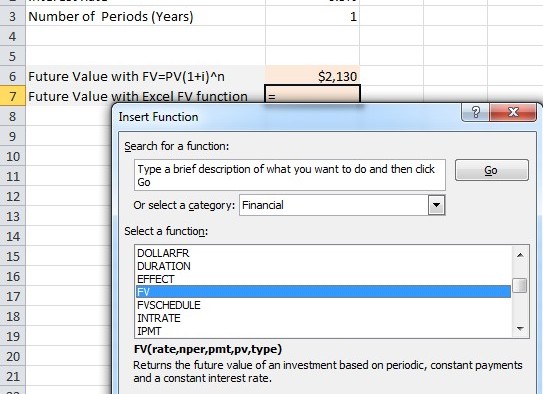

Before we test the formula, let's see how to create it again using the FV function. Select the cell and click on fx to bring up the function dialogue box. Under the Financial category, we find FV.

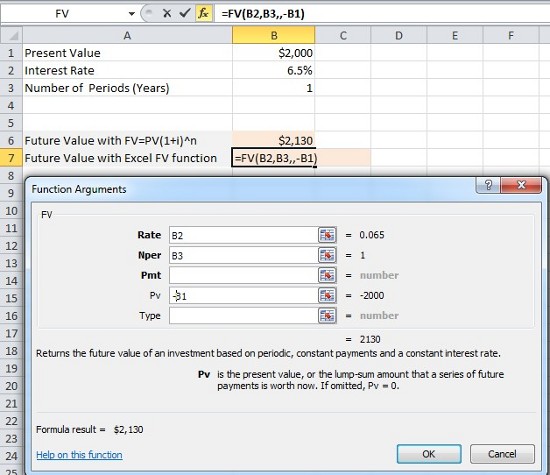

FV will open the Function Arguments dialogue box where we enter cell referacens as seen below. As you can see, we have made the Pv (present value) negative, so that the deposit sheet reflects a positive value.

The figures should be the same. We can now experiment with changing the period value to 10 years, to really see the power of compound interest.

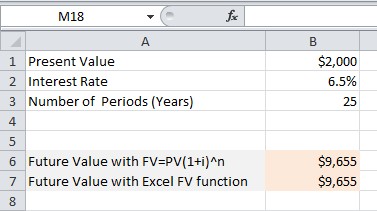

After 25 years, it's almost 5 times our original deposit.

For more help with financial formulas, contact our experts.